The Rising Appeal of Litigation Funding for Investors

Litigation funding is witnessing a surge in investor interest. Recent headline cases, such as the Post Office scandal, have increased awareness of third-party funding and highlighted its potential as an asset class.

Traditionally viewed as a cost centre, litigation is now recognised for its potential to generate attractive returns. According to a report by Research and Markets, the global litigation funding investment market was valued at approximately USD 18.2 billion in 2023 and is projected to reach USD 37.5 billion by 2028, growing at a compound annual growth rate (CAGR) of 13.2%. This growth trajectory begs a closer look at the factors driving investor enthusiasm for litigation funding.

Source: https://www.researchandmarkets.com/report/litigation-funding-investment

Understanding Litigation Funding

Litigation funding, also known as legal financing or third-party litigation funding, provides financial support to claimants involved in legal disputes. This financial support typically includes legal fees, court costs, and other litigation-related expenses, enabling claimants to pursue their legal claims without the burden of upfront costs.

There are various models within litigation funding. Large funders such as Burford Capital typically operate on a non-recourse funding basis, meaning they only recoup their investment if the case is successful. On the other hand, small-ticket funders like Fenchurch Legal, who specialise in high volumes of lower-value claims, use a model that includes upfront interest charges and ATE insurance. This approach ensures a steady income stream for the funder regardless of the case outcome, balancing risk and return.

The Growth of the Litigation Funding Market

The litigation funding market has experienced significant growth over the past decade, reflecting its increasing acceptance and attractiveness as an alternative investment class.

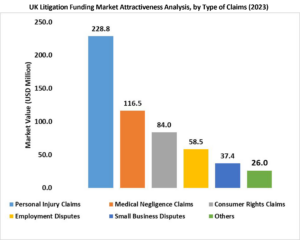

According to a report published on Lexlogy, the litigation funding market in England and Wales is one of the most mature globally and estimates for the UK market in 2023 range from £1.5 billion to £4.5 billion.

The expansion is driven by favourable legal environments and growing awareness of the benefits of litigation funding. The rising costs of legal proceedings have made litigation funding an essential resource for claimants who might otherwise be unable to afford to pursue their claims. Additionally, the diversification benefits and potential for high returns have attracted a wide range of investors, from high-net-worth individuals to hedge funds.

The Allure of Litigation Funding for Investors

As the sector has matured, new capital has entered the market, offering investors a wider range of sub-sectors to invest in, from traditional single-case funding to litigation funding loan notes.

Higher Potential Returns

Litigation funding offers attractive returns compared to traditional asset classes. Non-recourse investments can yield returns between 20% to 30%, driven by successful case outcomes. In contrast, investing in smaller cases at high volumes, often referred to as small-ticket litigation funding, can provide stable returns in the range of 11% to 15%. These investments carry lower risk and offer returns regardless of the case’s outcome.

Portfolio Diversification

Investing in litigation funding provides significant diversification benefits. Small-ticket litigation investments offer predictable and stable returns similar to fixed-income investments. This allows investors to diversify their portfolios beyond traditional bonds and stocks.

Non-Correlation with Traditional Markets

A key attraction for investors is that litigation funding investments are generally uncorrelated with other asset classes, such as government bonds or equities, which respond to economic cycles. This non-correlation allows investors to achieve stable returns irrespective of broader financial market fluctuations and economic downturns.

The Selection Process of Litigation Funding

Litigation funders are highly selective, choosing cases with a high chance of success to maximise returns and minimise risk. Factors considered during case selection include the legal merits of the case, potential damages, and the strength of the legal precedent. For large cases, funders look for significant potential recoveries and solid legal grounds, often involving high-stakes commercial disputes.

Small consumer claims, such as housing disrepair or financial mis-selling, are also favoured due to their established legal precedents and high success rates. This rigorous selection process ensures that funded cases have a strong likelihood of favourable outcomes, providing stability and attractive returns for investors.

Source: Stats and Research | www.statsandresearch.com

Success Stories and Case Studies

Litigation funding has proven its value through numerous high-profile and small consumer cases, delivering significant returns for investors. Below are two notable examples:

High-Profile Case: The Post Office Scandal

The Post Office Scandal is a landmark case in UK litigation history. Hundreds of sub-postmasters were wrongfully accused of theft and fraud due to faults in the Horizon computer system. Litigation funding played a crucial role in enabling these individuals to seek justice. In 2019, a group litigation order resulted in a £58 million settlement for the claimants, highlighting the profound impact of litigation funding in high-stakes cases. This case underscores the potential for substantial returns from large, complex litigation.

Small Consumer Claims: PPI Claims

The mis-selling of Payment Protection Insurance (PPI) is another significant example of successful litigation funding in small consumer claims. The PPI scandal involved banks and financial institutions mis-selling insurance policies to millions of consumers. Litigation funding enabled numerous claimants to pursue their cases, leading to compensation payouts exceeding £38 billion. This demonstrates how litigation funding supports access to justice for everyday consumers and can yield stable returns from a high volume of smaller cases.

These examples illustrate how litigation funding can deliver impressive returns for investors across both large-scale, high-profile cases and smaller consumer claims.

Future Outlook and Opportunities

Recent socio-economic factors, such as Brexit and the PACCAR decision, have impacted the landscape but despite these challenges, the UK remains an attractive jurisdiction for litigation.

Advancements in technology, such as AI and data analytics, are enhancing case assessment and risk management, making litigation funding more efficient. These technologies help funders identify high-potential cases and streamline operations.

Investors can look forward to new opportunities in emerging markets and sectors, including environmental, social, and governance (ESG) litigation, which is gaining traction.

Conclusion

At Fenchurch, we anticipate that the uncorrelated nature of litigation, together with the prospect of stable returns, will continue to attract a broad range of investors. This includes many mainstream investment managers, contributing to the increasing momentum behind the use of third-party funding in English litigation. With its proven track record and promising future outlook, litigation funding stands out as an attractive option for savvy investors.

For more information on our funding solutions or litigation funding investment opportunities, please contact us.