Litigation Funding: A Beginner’s Guide for Investors (2025)

Litigation funding has grown significantly in recent years, offering investors a unique opportunity to diversify their portfolios and achieve steady returns. Despite its growth, this asset class remains relatively niche and underexplored by many investors.

In this guide, we’ll explore the basics of litigation funding, distinguish between the different types of funding models, the role it plays in the UK legal system, and introduce Fenchurch Legal’s approach.

Whether you’re new to alternative investments or looking to expand your portfolio, this guide will provide you with the foundations to understand litigation funding investments.

1. What is Litigation Funding?

Imagine a small business or individual facing a legal Goliath – litigation can be expensive, leaving many with unequal access to justice. Litigation funding, also known as legal finance, bridges this gap by providing financial support for meritorious claims.

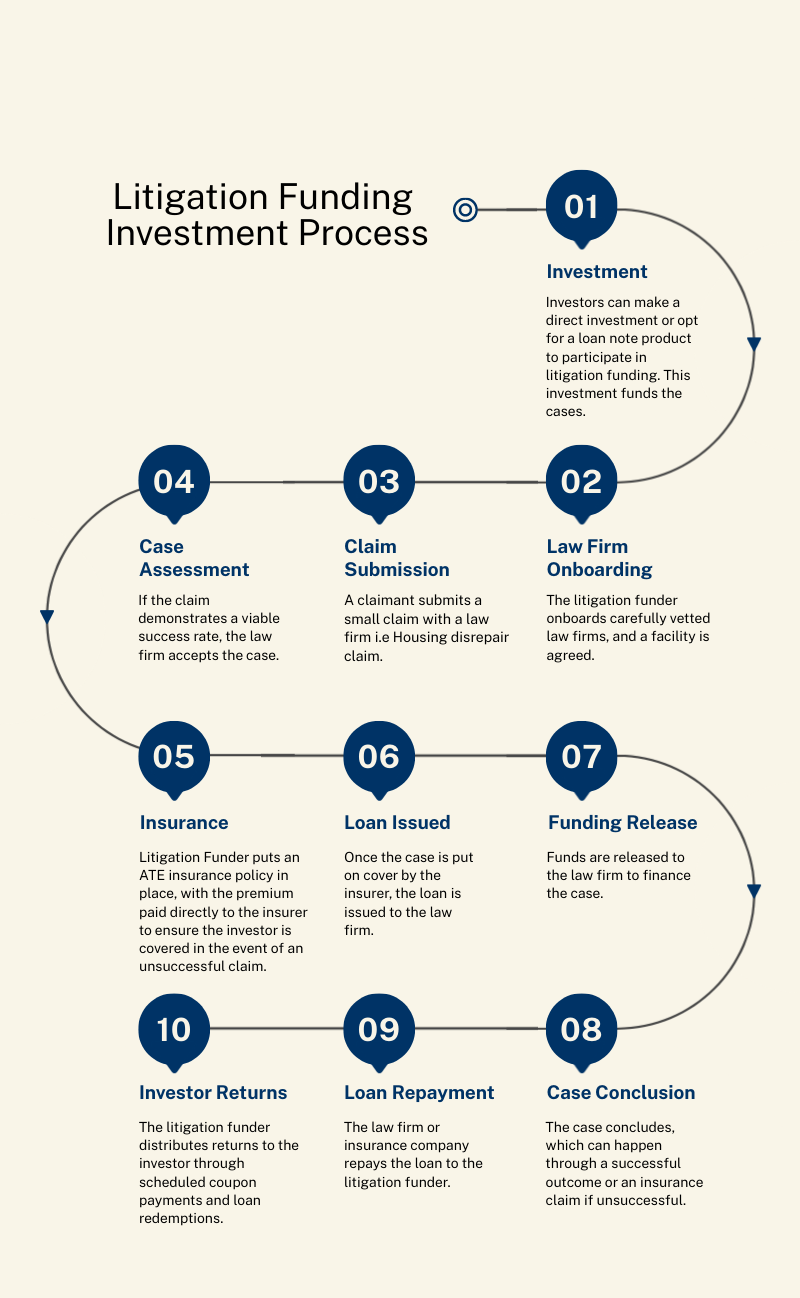

Funders receive a return on their investment, and the return structure can vary depending on the type of litigation funding involved, which is why it’s essential to understand the distinctions within this asset class.

Litigation funding can cover a wide range of claims, from large class actions to smaller consumer claims. Here are the two main types:

- In this model, funding is provided for high-value, complex legal cases, such as commercial disputes or class actions.

- Returns are contingent upon the outcome of the cases. If the claim is successful, the funder receives a share of the damages, but if unsuccessful, the funder typically loses their investment.

- This approach carries a higher risk-reward profile.

- This model used by Fenchurch Legal funds multiple low-value consumer claims, such as housing disrepair or financial mis-selling cases.

- Returns are derived from interest on loans, independent of case outcomes, thanks to ATE insurance covering unsuccessful claims – making it a more predictable and lower-risk investment.

- The focus on high volumes of smaller claims ensures steady returns and broader risk diversification.

2. The Role in the UK Legal System

In today’s legal landscape, rising legal costs and resource-intensive cases present challenges for UK law firms. Litigation funding has become a vital tool, helping law firms navigate financial challenges while enhancing their case-handling capabilities.

Demand is growing for litigation funding, and key reasons why law firms are opting to use litigation funding include:

- Increased Case Capacity: Litigation funding allows law firms to take on more meritorious cases that would otherwise be challenging due to financial constraints.

- Manage risk: By offsetting litigation expenses and adverse costs, funding helps law firms manage financial risk on their balance sheets.

- Frees up capital: With litigation funding, law firms can free up capital to invest in their business development and operations, avoiding the burden of upfront litigation costs.

4. Comparing Litigation Funding with Traditional Investments

Investors seeking alternatives to traditional markets are increasingly drawn to litigation funding, and small-ticket litigation funding offers several benefits for professional investors looking for new investment opportunities.

• Low Correlation: Unlike stocks and bonds, litigation funding is largely uncorrelated with traditional markets, providing a hedge against economic volatility, and offering the potential for consistent returns.

• Fixed Income Potential: Historically, small ticket litigation funding has generated returns of 10-14% per annum, significantly outperforming traditional asset classes.

• Predictable Returns: Returns are derived from interest payments on loans, creating a stable and reliable income stream for investors.

6. Unique Features of this Funding Model

Litigation funding stands out from traditional investments due to its unique security features and portfolio diversification, making it a reliable option for investors seeking alternative investments.

Security

- Insurance-backed: Fenchurch Legal only funds cases that are supported by an After the Event (ATE) insurance policy, covering all costs and disbursements if the case is unsuccessful.

- Upfront Fees: Each loan issued to law firms includes upfront fees, which are non-refundable regardless of the case outcome.

- Debentures: First-charge debentures are secured over the borrower’s assets, with additional corporate guarantees enhancing the security package where applicable.

- Assignment: Fenchurch has assignment over all case and insurance proceeds to cover the full amount of the loan disbursed.

Portfolio Diversification

Funding small-ticket ATE claims at high volumes offers great portfolio diversification. This strategy effectively spreads the risk across multiple law firms, individual cases and case types, reducing the reliance on the success of a single case.

7. Getting Started With Litigation Funding

In conclusion, litigation funding presents a compelling alternative investment opportunity, offering investors steady returns, portfolio diversification, and unique security. Fenchurch Legal’s approach, focusing on small-ticket, provides a stable entry point for investors wanting to explore this market.