Layers of Risk Management in Litigation Disbursement Funding

Litigation disbursement funding is a specialised area within the broader litigation funding sector. At Fenchurch Legal, our approach operates more like a finance company. Unlike traditional larger litigation funders, whose returns are outcome-based, our lending model is structured to be repayable regardless of the case result.

This approach brings additional security and predictability to our operations and this distinction, combined with our unique lending model, requires us to implement a robust risk management strategy.

Like any lending business, risk management is at the heart of our operations and encompasses various strategic assessments and checks from the initial onboarding to continuous and proactive monitoring and auditing.

At Fenchurch Legal, unnecessary risks are avoided by only providing loan facilities to carefully vetted law firms, and funding case types that are well-understood, backed by legal precedent, and within our established expertise.

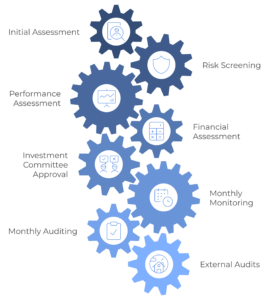

Here are the layers of risk management that Fenchurch Legal have in place:

1. Initial Assessment

After an introductory call with a law firm, we conduct an initial assessment to determine their eligibility for funding and whether to pursue the funding application. This involves a detailed review of key documents, including financials (management accounts and audited financial statements), claim information, and success rates.

These metrics allow us to assess the law firm’s financial health, operational performance, and track record. If the law firm meets our eligibility requirements, they move forward to the next stage of our process.

2. Risk Screening

Once a law firm accepts the Heads of Terms, we ask our external risk screening partners to conduct a detailed risk evaluation of the business. This includes a complete review of the law firm’s directors and shareholders, assessing their backgrounds and identifying any adverse findings.

This screening provides valuable insights into the broader risk profile of the law firm, helping us to confirm their eligibility for borrowing.

3. Performance Assessment

Following the risk screening process, we conduct a comprehensive due diligence review of the law firm’s business operations. This involves an in-depth analysis of various aspects including:

- Operational Processes: Evaluating the firm’s technology, staffing, and organisational structure.

- Litigation Strategy: Reviewing case selection criteria and approach to litigation.

- Past Performance: Analysing historical performance data, including progress reports and success rates.

- Compliance and Insurance: Assessing adherence to regulatory requirements and adequacy of insurance coverage.

- Management and Governance: Examining the firm’s leadership team, decision-making processes, and governance framework.

- Growth Strategy: Understanding the firm’s plans for future expansion and sustainability.

This comprehensive assessment provides a clear understanding of the firm’s operational soundness, strategic alignment, and potential risks.

4. Financial Assessment

Our Senior Financial Controller performs a detailed analysis of the law firm’s financial management. This review includes an evaluation of cost controls, revenue recognition practices, and WIP accounting to ensure transparency and proper financial reporting. Additionally, we analyse the firm’s financial projections to help us understand and predict the firm’s financial stability and flag any historical concerns.

5. Investment Committee Approval

Following weeks of in-depth due diligence, including input from third-party experts, a report is prepared for our Investment Committee.

Our Investment Committee, comprising of both internal members and external non-executive directors, meets to review the findings and make the final decision on approving a loan facility to the law firm.

6. Monthly Monitoring

Once a law firm is onboarded, we have a structured process for regular updates to ensure we have a thorough understanding of the law firm’s performance and can proactively address any potential risks.

Through our secure data-sharing platform, law firms are required to upload key documents, including progress reports, management accounts, WIP reports, ATE claims reports, and bank statements, in a timely manner.

In addition, we also ask for further information on a quarterly basis which includes 3-month cash flow forecasts and success rate data.

7. Monthly Auditing

We employ a dedicated Legal Claims Auditor who conducts monthly audits, reviewing case progress and verifying that everything is proceeding as expected. At the beginning of each month, we provide a list of sample cases selected for audit. Once the audit is complete, we prepare a detailed report and share it with the law firm, requesting their comments on any identified issues.

8. External Audits

To provide an additional layer of independent verification, we work with a specialist legal auditing firm to conduct quarterly audits. These audits focus on evaluating case progress and ensuring compliance, further strengthening our overall risk management strategy.

At Fenchurch Legal, risk management is more than a procedural requirement – it’s the foundation of everything we do! Our layered approach ensures that each stage of the process acts as a safeguard, providing a robust framework for assessing and mitigating risks. This strategy not only enables us to foster secure, long-term, partnerships with law firms but also protects our investments, ensuring stability and sustainability for all stakeholders.