Litigation Funding – A Beginner’s Guide for Investors

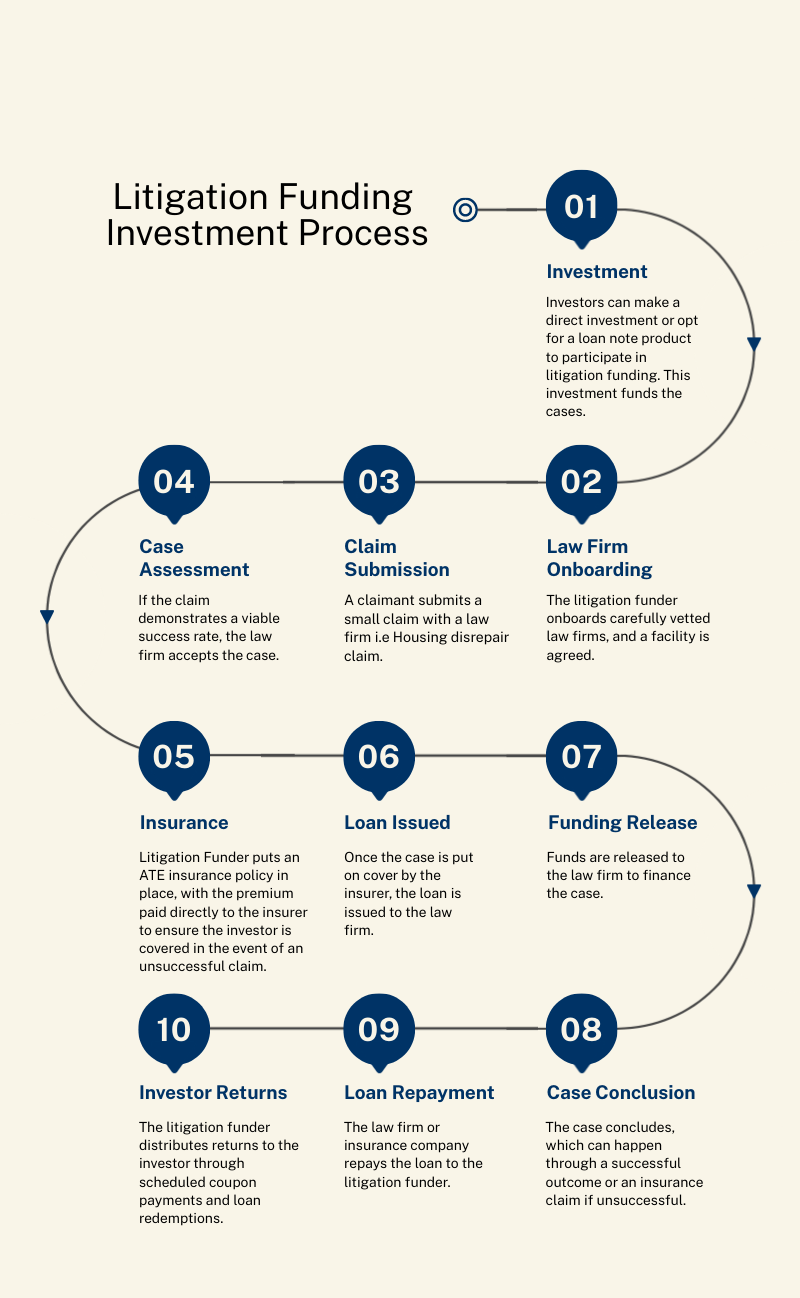

In this beginner’s guide, we’ll explore the basics of litigation disbursement funding for the small claims market, and its role in the UK legal system and discover how Fenchurch Legal offers an opportunity for investors to enter this growing market.

Investing in alternative finance is a great opportunity for investors who are looking to diversify their investment portfolio and achieve steady returns. An alternative finance asset that has started to gain significant traction in recent years, is litigation funding, with the global litigation funding market size being valued at USD 13.4 billion in 2022 and is expected to reach USD 43.05 billion by 2033.

1. UNDERSTANDING LITIGATION FUNDING

Imagine a small business or individual facing a legal Goliath – litigation can be expensive, leaving many with unequal access to justice. Litigation funding bridges this gap by providing financial backing to law firms handling meritorious claims.

Litigation funding can cover a wide range of claims, spanning from large class actions to smaller, individual consumer claims. Fenchurch Legal specialises in disbursement funding, supporting high volumes of smaller cases with high success potential.

2. THE ROLE IN THE UK LEGAL SYSTEM

In an era marked by rising legal costs and resource-intensive cases, litigation funding has become vital for UK law firms – serving as a strategic tool to navigate financial challenges. Key reasons why law firms are opting to use litigation funding include:

- Increased Cases: Funding allows law firms to take on more meritorious cases that would otherwise be challenging due to financial constraints.

- Manage risk: Funding helps to manage risks on their balance sheets effectively mitigating the potential financial exposure associated with litigation expenses and adverse costs exposure.

- Frees up capital: Litigation funding frees up capital for law firms, allowing them to allocate resources towards developing their business, rather than having a financial burden of upfront costs typically associated with handling litigation cases.

3. GROWING MARKET

The litigation funding market is experiencing substantial growth, with an increasing demand for funding disbursements in smaller cases. Investors have the opportunity to capitalise on this upward trend, positioning themselves in a market poised for continued growth. The growth is driven by factors like:

- Rising Legal Costs: The surge in litigation expenses has led to an increased demand for funding solutions.

- Increased Awareness: More law firms and potential investors are recognizing the benefits of litigation funding and its positive outcomes.

- Regulatory Changes: Supportive regulations in the UK have created a favourable environment for the market’s expansion.

4. LITIGATION FUNDING INVESTMENTS VS TRADITIONAL INVESTMENTS

Investors seeking alternatives to traditional markets are increasingly drawn to litigation funding, which presents features such as:

- Steady Returns: Historically, litigation funding has generated returns of 10-13% per annum, significantly outperforming traditional asset classes.

- Low Correlation: Unlike stocks and bonds, litigation funding is largely uncorrelated with traditional markets, providing a hedge against economic volatility, and offering the potential for consistent returns.

- Accessible Entry Point: Fenchurch Legal’s focus on smaller-ticket cases makes litigation funding a more accessible investment option, requiring lower minimum investment amounts

6. UNIQUE FEATURES

Litigation funding stands out from volatile traditional assets due to its unique security features and delivers investors with enhanced portfolio diversification.

Security

- Insurance-backed: Fenchurch Legal only funds cases that are supported by an After the Event (ATE) insurance policy, covering all costs and disbursements if the case is unsuccessful.

- Upfront Interest: The initial fixed rate of interest on each loan is charged upfront to the law firm which is nonrefundable regardless of the case outcome.

- Debentures: First-charge debentures are secured over the borrower’s assets, with corporate guarantees to support the security package further if applicable.

- Assignment: Fenchurch has assignment over all case and insurance proceeds, to cover the full amount of the loan disbursed.

Portfolio Diversification

Funding small-ticket ATE claims at high volumes offers great portfolio diversification. This strategy effectively spreads the risk across multiple law firms, individual cases and case types, reducing the reliance on the success of a single case.

7. GETTING STARTED WITH LITIGATION FUNDING

In conclusion, litigation funding emerges as an alternative investment opportunity, offering investors a unique avenue for steady returns and portfolio diversification. Fenchurch Legal’s emphasis on smaller-ticket claims, flexible entry points, and robust security features makes it an accessible and appealing choice for those looking to explore this dynamic market.

If you want to delve deeper into the potential of litigation funding and how Fenchurch Legal can be a valuable addition to your investment strategy, then get in touch for more information.